In the ever-evolving world of commodities, the price of gold remains one of the most significant and closely watched indicators of economic health. For investors, businesses, and consumers alike, understanding the trends and factors influencing the Canada gold price is crucial to making informed financial decisions. As we head into 2024, the Canadian gold market is showing some interesting shifts, with both global and domestic factors coming into play.

What is the Canada Gold Price?

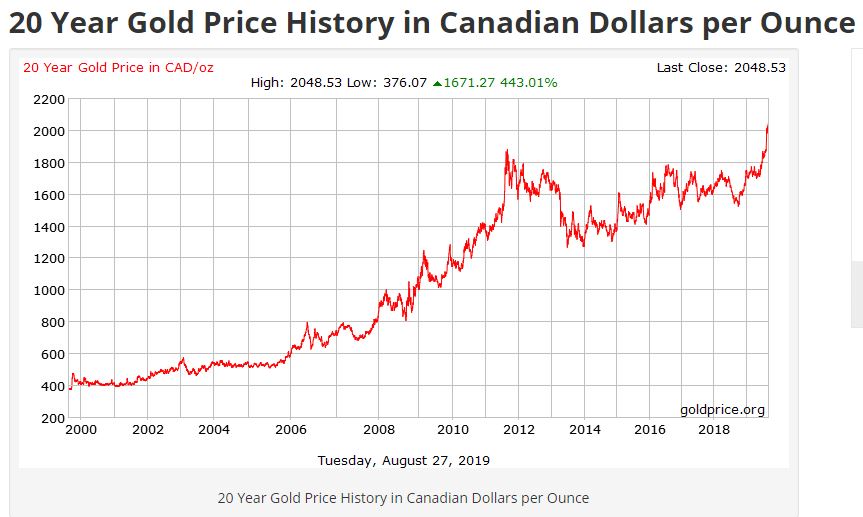

At its core, the Canada gold price refers to the value at which gold is bought and sold in Canada. Gold prices are typically quoted per ounce, and in Canada, these prices are influenced by a variety of domestic and international factors. These include the price of gold on international markets, the strength of the Canadian dollar, inflation rates, and geopolitical developments.

The Canada gold price is a critical metric for investors, especially those involved in gold trading, jewelry manufacturing, and mining industries. With Canada being one of the world’s top gold producers, the country’s price trends can have a substantial impact on global markets as well.

Why is the Canada Gold Price Important?

There are several reasons why understanding the trends in Canada gold price is important:

- Investment Opportunities: Gold has long been considered a safe haven asset. When stock markets are volatile, many investors turn to gold as a stable store of value. Tracking Canada gold price trends can help investors decide when to buy or sell, ensuring they capitalize on market movements.

- Currency Strength: The Canada gold price is influenced by the Canadian dollar’s performance. When the Canadian dollar weakens against other currencies, the price of gold typically rises in Canadian terms, offering additional opportunities for investors.

- Consumer Goods and Jewelry: For consumers, especially those in Canada, gold prices directly affect the cost of buying jewelry, electronics, and other gold-based products. Fluctuating prices can impact purchasing decisions and overall demand in the retail market.

- Economic Indicators: Gold prices are often seen as an economic indicator. Rising gold prices may suggest inflationary pressures or uncertainty in the global economy, while falling prices might indicate a period of economic stability or deflation.

Given its global importance and the diverse factors influencing it, the Canada gold price is a key consideration for anyone involved in financial planning or investment strategies.

Key Factors Impacting the Canada Gold Price

Several key factors influence the movement of the Canada gold price:

- Global Economic Conditions: Gold prices often rise during times of economic uncertainty or when inflation fears are high. In 2024, factors such as global economic recovery post-pandemic, rising inflation rates, and political instability could lead to higher gold prices in Canada.

- Interest Rates and Central Bank Policies: Central banks, including the Bank of Canada, play a crucial role in determining the cost of borrowing money through interest rates. When interest rates are low, gold prices tend to rise because the opportunity cost of holding gold (which doesn’t earn interest) is reduced. Conversely, higher interest rates can reduce demand for gold.

- Currency Movements: The relationship between the Canadian dollar and the US dollar is another significant factor. As gold is priced in US dollars globally, fluctuations in the value of the Canadian dollar against the US dollar can cause the Canada gold price to change. A weaker Canadian dollar can lead to higher gold prices in Canada, even if the global price of gold remains stable.

- Global Gold Supply and Demand: As one of the top gold producers globally, Canada plays a pivotal role in the overall supply of gold. Any disruptions in mining operations, whether due to environmental concerns or labor strikes, can affect the Canada gold price. Likewise, global demand from industries like jewelry, electronics, and investment can also push prices up or down.

- Geopolitical Events: Geopolitical instability, such as trade wars, military conflicts, or government policies, can drive people to seek out safe-haven assets like gold. For Canada, this means that international tensions or local economic disruptions could result in fluctuating gold prices.

Gold Price Trends in Canada for 2024

Looking ahead to 2024, experts predict several key trends in the Canada gold price:

- Continued Economic Uncertainty: With global inflation rates on the rise and the continued recovery from the COVID-19 pandemic, many investors are expected to continue turning to gold as a store of value. As the global economy grapples with supply chain disruptions and rising costs, the Canada gold price may see upward momentum.

- Stronger Demand for Safe-Haven Assets: Geopolitical tensions, particularly in Europe and the Middle East, along with ongoing trade disputes, are likely to increase demand for gold as a safe-haven investment. This could keep prices elevated throughout 2024, making gold an attractive option for Canadian investors looking to hedge against economic uncertainty.

- A Fluctuating Canadian Dollar: As the Canadian dollar continues to move in relation to the US dollar, it will affect the Canada gold price. If the Canadian dollar weakens further against the US dollar, gold prices in Canada could rise, providing opportunities for investors to profit.

- Mining Industry Challenges: Canada’s gold mining sector may face challenges in the coming years, including higher extraction costs and environmental regulations. These challenges could lead to a reduction in gold supply, which might drive prices up. On the flip side, any breakthroughs in mining technology could increase production and stabilize prices.

- Environmental and Regulatory Pressures: With increasing awareness of the environmental impact of mining activities, there may be greater scrutiny and regulations in the Canadian mining sector. These could affect the availability and cost of gold, impacting the Canada gold price.

How to Navigate the Canada Gold Price in 2024

For investors and businesses operating in the gold market, it’s essential to stay informed about the latest trends and forecasts. Here are a few strategies for navigating the Canada gold price landscape in 2024:

- Monitor the Global Economy: Keep an eye on global events that may affect the economy, such as inflation rates, interest rate changes, and geopolitical developments. These factors will provide insight into where gold prices are headed.

- Diversify Investment Strategies: For investors, gold should be part of a diversified portfolio. Whether you are buying physical gold, investing in mining stocks, or trading gold futures, it’s important to balance your investments to mitigate risks associated with gold price fluctuations.

- Stay Updated on Currency Movements: Since the Canada gold price is heavily influenced by the strength of the Canadian dollar, staying informed on exchange rates and central bank policies can help you anticipate price movements.

- Consult with Experts: If you’re looking to invest in gold or make strategic business decisions based on the Canada gold price, it’s wise to consult with financial advisors or industry experts who can help guide your strategy based on the latest data and trends.

The Consequences of Ignoring Gold Price Trends

Failing to monitor and understand the Canada gold price can have serious consequences for businesses and investors. A lack of awareness could lead to missed opportunities for profit, or worse, significant losses in times of economic turbulence. Additionally, businesses that rely on gold for manufacturing or retail could face increased costs, affecting their bottom line.

Building Long-Term Gold Investment Strategies

As with any investment, building a long-term strategy for gold requires careful planning, patience, and constant attention to market conditions. By staying informed about the Canada gold price and factoring in key global and local influences, investors can maximize returns and minimize risks. Gold has always been seen as a hedge against inflation, and in 2024, it is expected to continue serving that role for many.

Conclusion

As we move into 2024, the Canada gold price is expected to be influenced by a combination of global economic factors, interest rates, currency movements, and geopolitical events. Whether you are an investor looking for a stable store of value or a business needing to adjust to fluctuating gold prices, understanding these trends will be key. By staying informed, monitoring market developments, and making strategic decisions, you can navigate the complexities of the gold market and make the most of the opportunities it offers.