In today’s digital world, the lines between convenience and security are often blurred. With platforms like Bidenscash.cc gaining popularity, concerns about personal data are rising to the forefront. This controversial platform not only allows users to buy and sell various goods but has also been linked to unsettling practices surrounding sensitive information

—particularly credit scores. How safe is your financial information in this rapidly evolving marketplace? Are your credit details vulnerable to exploitation? These questions deserve answers as we navigate through the complexities of online transactions and privacy protection. Let’s dive into what Bidencash means for you and how you can safeguard your financial future amidst these challenges.

The Rise of Bidencash and Its Controversies

Bidencash has emerged as a significant player in the digital transaction landscape, drawing both interest and scrutiny. Launched with the promise of ease in buying and selling, it quickly garnered a large user base eager to engage in what some view as modern commerce.

However, this rapid growth hasn’t come without its controversies. Users have raised alarms over allegations of data misuse and unauthorized transactions. The platform’s handling of personal information remains questionable, leading many to wonder about their privacy.

In addition, critics argue that Bidencash operates in a gray area regarding regulations and consumer protection laws. As it continues to expand its influence online, discussions around transparency and ethical practices are becoming increasingly urgent among users and watchdogs alike.

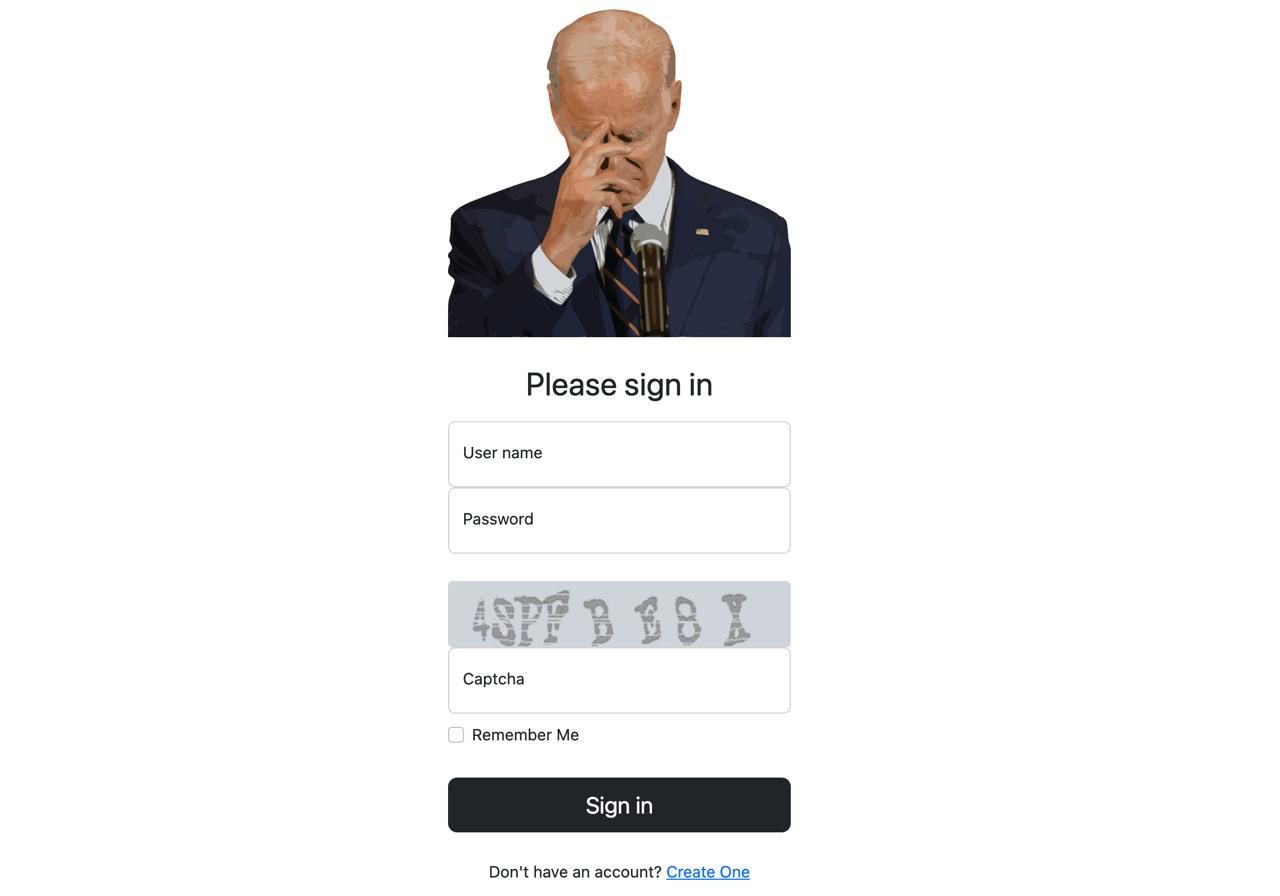

A Screenshot of Bidencash (bidenscash.cc) login page

How Your Credit Score is Being Used on Bidencash

Bidenscash.cc is making waves in the digital transaction landscape. But there’s a darker side to its appeal. Your credit score may be at risk.

On this platform, personal financial metrics are becoming commodities. Users might not realize how their data is being utilized. Credit scores can influence bidding decisions and loan opportunities within the network.

This means those with higher scores could command better deals or higher bids for services offered on Bidencash login. It creates an environment where your financial reputation becomes a bargaining chip.

Moreover, unauthorized access can lead to significant breaches of privacy. Personal information linked to your credit history can easily fall into the wrong hands if proper security measures aren’t enforced by the platform.

Understanding these dynamics is crucial as you navigate this new arena of online transactions and bidding wars over finances.

Related: Jokerstash

The Impact on Your Financial Security and Privacy

The emergence of platforms like Bidencash raises important concerns about financial security. When credit scores are traded or exposed, users become vulnerable to identity theft and fraud.

Hackers can easily exploit this information, leading to unauthorized access to bank accounts or loans taken out in someone else’s name. The repercussions can be devastating, affecting one’s ability to secure future credit.

Privacy is another critical issue at stake. Our personal data should remain confidential, yet the digital age complicates matters. Each time you share your information online, it risks falling into the wrong hands.

Understanding how your data is used on these platforms is essential for safeguarding your financial wellbeing. With every transaction made through Bidencash or similar services comes a potential threat that must not be overlooked. Staying informed and vigilant will help mitigate these risks significantly.

Steps to Protect Yourself from Unauthorized Access to Your Credit Score

To safeguard your credit score, start by monitoring your financial accounts regularly. Look for any suspicious activity that could indicate unauthorized access.

Next, consider placing a fraud alert on your credit report. This simple step notifies potential lenders to take extra precautions before approving new accounts in your name.

Using strong, unique passwords for online banking and financial services is crucial as well. Avoid using easily guessable information like birthdays or names.

Enable two-factor authentication wherever possible. This adds an additional layer of security beyond just a password.

Obtain free copies of your credit report annually from the major bureaus. Check them thoroughly for errors or unfamiliar accounts that may indicate identity theft. Taking these proactive measures can significantly reduce risks related to unauthorized access to your credit score.

Alternative Ways to Check and Monitor Your Credit Score

There are several trusted methods to check and monitor your credit score without relying on platforms like Bidencash. One popular option is using free annual credit reports offered by major bureaus: Experian, Equifax, and TransUnion. You can access one report from each bureau every year.

Another effective way is through various reputable financial apps. Many of these tools not only provide real-time updates on your credit score but also send alerts for any significant changes or inquiries.

Consider subscribing to a dedicated credit monitoring service as well. These services often offer comprehensive features such as identity theft protection and personalized tips for improving your score.

Regularly reviewing your bank statements can help you spot unauthorized transactions early on. Awareness is key when it comes to protecting your financial health in this digital age.

Legal Actions Against Bidencash and Other Similar Platforms

Legal actions against Bidencash cc and other similar platforms are gaining momentum. The core issue revolves around unauthorized data usage, including sensitive credit information.

Regulatory bodies are scrutinizing these companies for potential breaches of privacy laws. Lawsuits from affected consumers are also on the rise, claiming damages due to misuse of their financial data.

Some states have already initiated investigations into how these platforms operate. They aim to determine whether they comply with existing regulations designed to protect consumer rights.

Additionally, advocacy groups are pushing for stricter legislation governing digital transactions. Their goal is to create a safer environment for users navigating online financial services.

As awareness grows, it becomes clear that the legal landscape surrounding such platforms is evolving rapidly. Consumers should stay informed about pending cases that may impact their personal and financial security in this digital age.

Conclusion: Staying Vigilant in the Age of Digital Transactions

The rapid rise of platforms like Bidencash has raised significant concerns about the security of personal financial information, particularly credit scores. As these digital marketplaces grow, so do the risks associated with them. The potential for your credit score to be exploited or sold is alarming.

Taking proactive steps to protect yourself is crucial in this evolving landscape. Regularly monitoring your credit report and utilizing alternative services can provide you with peace of mind. Being aware of how your information can be shared on such platforms empowers you to make informed decisions.

As legal actions unfold against Bidenscash.cc and similar entities, staying vigilant becomes even more important. By remaining educated about your financial rights and taking preventive measures, you can better safeguard your personal data from unauthorized access.

Embracing a culture of awareness will serve you well as we navigate this increasingly digitized world where our financial identities are at stake.